Residual value loan and car lease are so similar that many people may find it difficult to tell the difference.

Both options reduce your monthly payment burden by setting a residual value, but they differ in terms of whether interest is charged and what costs are included in the monthly fee. For those who don’t know what the difference is between a car lease and a residual value loan, or those who wish to use the more economical option after comparing the two, we will tell you how each of them works and their features.

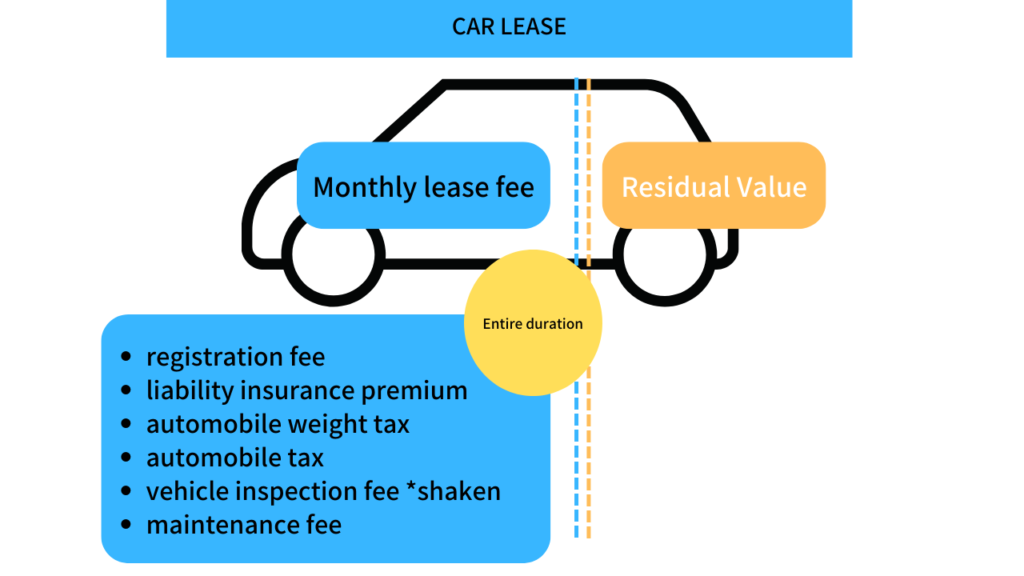

How Car Leases Work

In a car lease, the price of the car at the end of the contract (residual value) is set, and the amount excluding the residual value is paid as the monthly lease fee (monthly fee).

Setting the price of the car at the expiration of the contract (residual value) is called residual value setting. For example, if a 4 million yen car is projected to sell for 2 million yen after 5 years, 2 million yen is the residual value of that car after 5 years. The remaining 2 million yen is to be paid in installments over the term of the contract.

The major advantage of residual value in car lease is that the residual value is deducted, which reduces the payment burden compared to paying the full vehicle price.

Taxes, vehicle inspections, and other costs other than the price of vehicle itself

Generally, the monthly payment is fixed because the cost of maintaining the car is included in the lease price from the beginning and is divided accordingly. Major items included in the lease fee are registration fee, liability insurance premium, automobile weight tax, automobile tax (by type) and vehicle inspection fee. In addition, some plans can include the cost of maintenance. Compared to a residual value loan, it is less likely to incur large one-time expenses and can be used like a private car.

Cancellation before maturity

In principle, car leases cannot be cancelled before maturity. However, it is possible with the approval of the leasing company. A mid-term termination fee will be charged if the car is returned before maturity. The calculation method is as follows:

Mid-term termination fee = (lease payment for remaining term + administrative fee + residual value) – (appraised value of the vehicle + unexpired portion of the cost*)

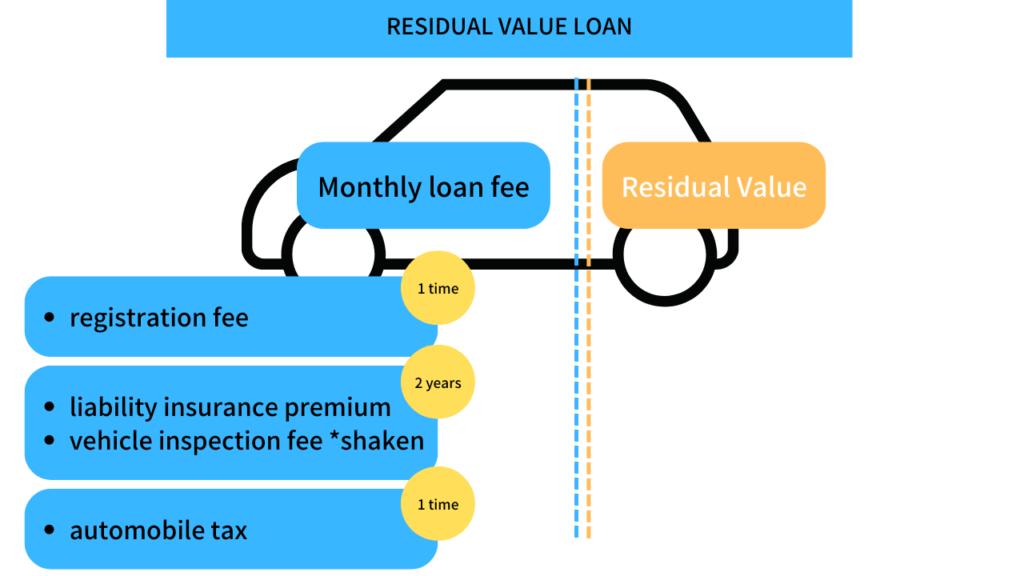

Residual Value Loan

Residual Value Loan is a loan based on the assumption that the customer will return or replace the vehicle after several years, and the guaranteed purchase price at the time of return or replacement is set as the residual value.

With a residual value loan, the remaining amount, excluding the set residual value, is paid in installments, resulting in lower monthly repayments compared to a regular loan. In addition, interest rates tend to be lower than for regular loans. After the loan payment term ends, you can choose one of the following options:

・Replace the car with a new one

・Pay the residual value and continue driving

・Return the car to the dealer

Taxes, vehicle inspections, and other costs other than the price of vehicle itself

With a residual value loan, you are responsible for and manage your own taxes and maintenance costs. Monthly payments can be lower, but there are costs associated with each tax payment and vehicle inspection. As for the burden of maintenance costs, it is no different than owning your own vehicle. A budget for maintenance, separate from monthly payments, should be considered.

Cancellation before maturity

・Make early repayments

In early repayment, the remaining balance of the loan, including the residual value, is paid in a lump sum.

・Continue to make payments as is

If payments are continued, the remaining balance is paid in the final payment installment.